4 Financial Expert Strategies on Managing Your Wealth on Your Own Terms

Managing your wealth effectively is crucial for your financial well-being and long-term success. Whether you’re just starting your journey to financial independence or looking to optimize your existing wealth, understanding the strategies employed by financial experts can provide invaluable guidance. While seeking professional advice is always an option, there’s also merit in taking control of your finances and managing your wealth on your terms. So read on to explore four expert strategies that can help you effectively manage your wealth and achieve your financial goals.

1. Creating a Comprehensive Financial Plan

One of the first steps toward managing your wealth is to develop a comprehensive financial plan. This strategy involves assessing your current financial situation, setting realistic goals, and outlining a roadmap to achieve them. If you’re new to financial planning, find a course or mentor and be part of their actively managed certificate program to get educated in planning.

Start by examining your income, expenses, and debts. Consider your short-term and long-term financial objectives, such as saving for retirement, buying a house, or funding your children’s education. A well-crafted financial plan will provide you with a clear understanding of where your money is going, identify areas for improvement, and help you prioritize your financial goals.

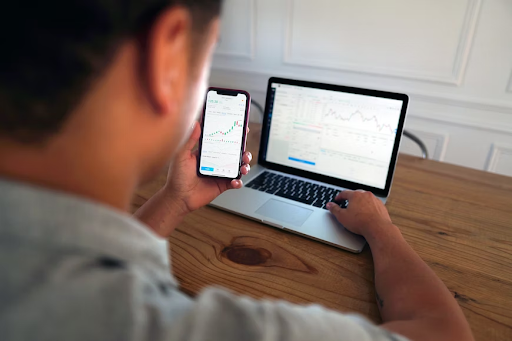

2. Diversifying Your Investments

Diversification is a fundamental strategy used by financial experts to manage risk and maximize returns. Instead of putting all your eggs in one basket, spread your investments across different asset classes, industries, and geographical locations. This approach reduces the impact of a single investment’s performance on your overall portfolio. Consider investing in stocks, bonds, real estate, mutual funds, and other financial instruments based on your risk tolerance and investment horizon. Regularly review and rebalance your portfolio to ensure it aligns with your financial goals and risk appetite.

The Types of Investments to Consider

When diversifying your investments, it’s important to understand the different types of assets available to you. By allocating your funds across a variety of investment vehicles, you can reduce the overall risk associated with any single investment.

- Stocks: Investing in individual stocks involves purchasing shares of ownership in a specific company. Stocks can offer the potential for high returns but also carry a higher level of risk. To mitigate risk, consider investing in a diversified portfolio of stocks across various sectors and market capitalizations.

- Bonds: Bonds are debt securities issued by governments, municipalities, and corporations. When you invest in bonds, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are generally considered less risky than stocks and can provide a stable income stream.

- Real Estate: Investing in real estate can offer both income and appreciation potential. You can invest directly by purchasing properties or indirectly through real estate investment trusts (REITs) or real estate mutual funds. Real estate investments can provide diversification by adding an asset class that behaves differently from traditional stocks and bonds.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer instant diversification across a range of investments and are managed by professional fund managers. Mutual funds can be tailored to different risk levels and investment goals, making them suitable for various investors.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs offer diversification by holding a basket of securities. However, unlike mutual funds, ETFs are traded on stock exchanges, allowing you to buy and sell shares throughout the trading day. ETFs can track specific indexes, sectors, or asset classes, providing exposure to a broad range of investments.

- Alternative Investments: Alternative investments encompass a wide range of assets, including private equity, hedge funds, commodities, and derivatives. These investments can be more complex and have higher minimum investment requirements. Alternative investments offer the potential for diversification beyond traditional asset classes, but they also come with higher risks and may require more specialized knowledge.

Remember, diversification does not guarantee profits or protect against losses, but it can help manage risk in your investment portfolio. Regularly review your investments, assess their performance, and rebalance your portfolio if necessary to ensure it aligns with your financial goals and risk tolerance. Consult with a financial advisor to determine the optimal diversification strategy based on your specific circumstances and investment objectives.

3. Adopting a Disciplined Saving and Spending Strategy

Building wealth requires a disciplined approach to both saving and spending. To adopt a disciplined saving and spending strategy, start by setting clear financial goals. Determine what you want to achieve in the short-term and long-term, whether it’s saving for a down payment on a house, building an emergency fund, or planning for retirement. Having specific goals will give you a sense of purpose and motivation.

Next, create a budget that outlines your income and expenses. Track your spending habits to identify areas where you can cut back or eliminate unnecessary expenses. Look for ways to reduce costs without sacrificing your quality of life. For example, consider cooking at home instead of dining out, finding affordable alternatives for entertainment, or negotiating better deals on your bills.

Automating your savings is a powerful technique to ensure consistent contributions to your savings and investment accounts. Set up automatic transfers from your checking account to your savings account or investment portfolio. This approach eliminates the temptation to spend money and makes saving a regular habit.

Prioritize your financial goals based on their importance to you. Allocate a portion of your income towards each goal, ensuring that you’re making progress on multiple fronts.

4. Continuously Educating Yourself

Managing your wealth effectively requires staying informed about financial trends, strategies, and market conditions. Commit to lifelong learning by reading books, attending seminars, or following reputable financial blogs and podcasts. Equip yourself with knowledge of personal finance, investment principles, tax strategies, and estate planning. The more you educate yourself, the better equipped you’ll be to make informed decisions about your wealth. Stay updated on economic trends and be prepared to adjust your financial plan and investment strategy accordingly.

Managing your wealth on your terms empowers you to take control of your financial future. By adopting these expert strategies, you can create a comprehensive financial plan, diversify your investments, follow a disciplined saving and spending strategy, and continuously educate yourself about personal finance. While seeking professional advice can be beneficial, these strategies will enable you to make informed decisions and shape your financial destiny according to your unique goals and values. Remember, building wealth is a journey, and by implementing these strategies, you’re on your way to financial success on your terms.